Learn About the Cost of the Plan

On or before Tuesday, November 4, residents will decide whether to invest $21.7 million for critical facility and educational improvements at both schools by casting their vote. The proposed plan includes building a fine arts learning center addition, a new secured entrance and office area, adding windows to several classrooms, replacing underfloor sewer pipe, and other improvements at our junior/senior high school. The plan also includes replacing the original 1954 elevator and making additional exterior and interior improvements, such as tuckpointing and door replacements at our elementary school.

Across the State of Minnesota, facility improvements for public schools are funded through property tax increases. Our district and school board are committed to using taxpayer dollars wisely across all areas, particularly for a proposed building bond referendum like ours. We have worked carefully to ensure that the proposed $21.7 million bond referendum reflects residents' priorities and provides high value for taxpayer investment in our school.

If approved by voters, this investment would be supported by a property tax increase that would take effect in 2026 and expire after 2046 or when the bonds for the project have been paid, whichever happens sooner. If approved, all revenue from the tax increase will go directly to the proposed projects. Our district cannot spend more than the amount stated on the ballot or use the funds for additional projects not included in the referendum plan.

How does the plan impact my property taxes?

Your individual tax impact will depend on the value of the property you own. For a $200,000 residential home in the district, the estimated tax impact is approximately $7 per month starting in 2026. For an agricultural homestead with an estimated market value of $10,000 per acre, the estimated tax impact would be $0.06 per acre per month ($0.75 per acre per year) starting in 2026.

You can calculate your estimated tax impact using our tax calculator here.

Attention agricultural landowners!

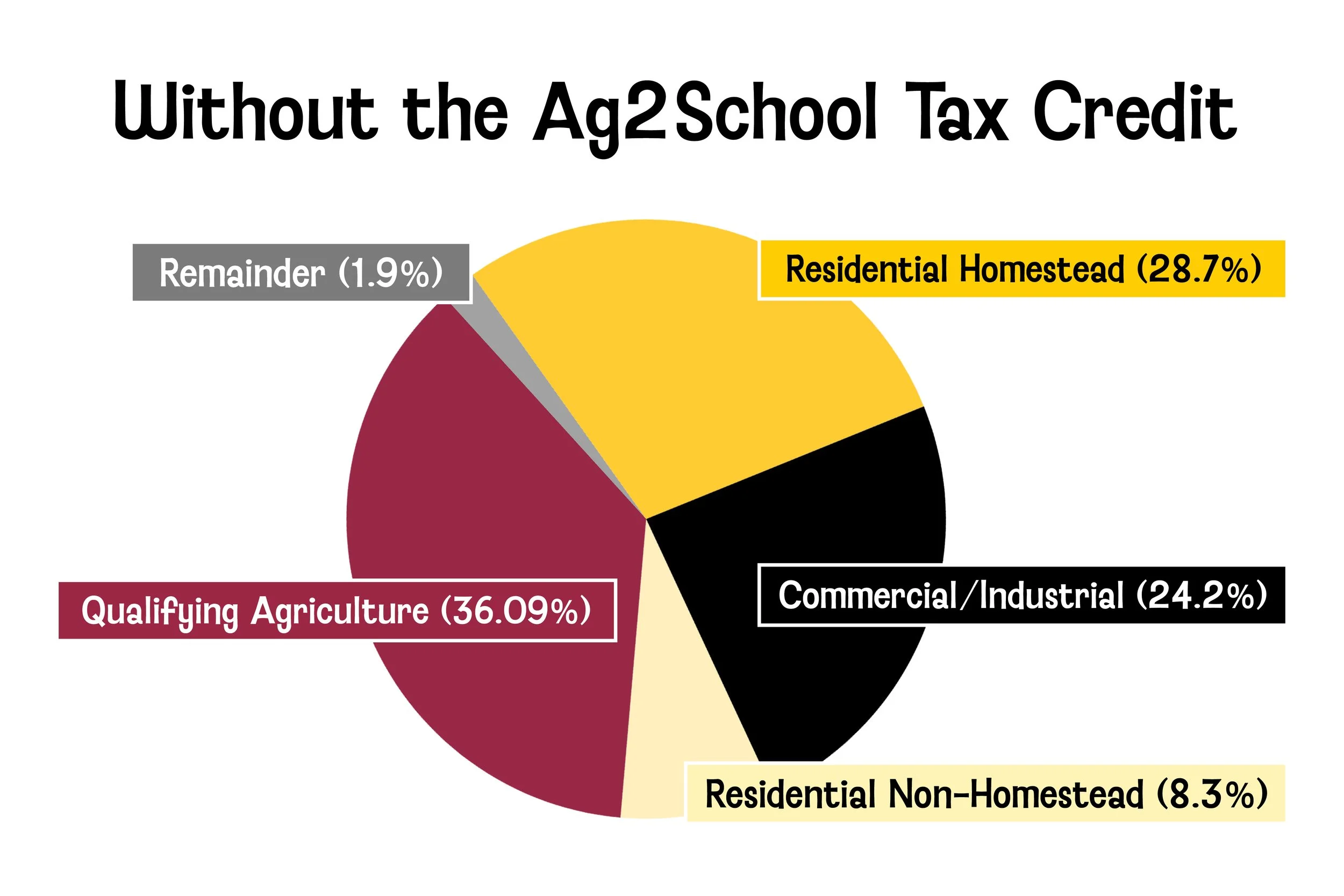

The State of Minnesota’s Ag2School Tax Credit is a 70% tax credit provided to all agricultural property except the house, garage, and one acre surrounding the agricultural homestead for building bond referendums. This is not a tax deduction – it’s a dollar-for-dollar credit and is an automatic tax credit paid directly by the state with no application required. This credit would remain at 70% for the life of the bond.

The State of Minnesota’s Ag2School Tax Credit reduces the contribution percentage for agricultural landowners to 30%. If approved, approximately 26% of the total bond referendum’s principal and interest will be covered by the state’s 70% tax credit.

Potential Ways to Offset Your Tax Impact

You may be eligible for ways to offset increases to your property taxes from the referendum, including:

Homestead credit refund: the state’s largest property tax refund program.

Special one-year refund: for excessive increases (12% increase and at least $100).

Senior tax deferral: helping those 65+ manage property tax bills.

Renters’ property tax credit: tax relief for renters.

The referendum may make you eligible for these refunds/credits or may increase the amount from any refunds/credits you already receive. In addition, an increase in property taxes may be deductible on your federal tax return if you itemize deductions.

The Homestead Credit Refund program began in 1967 and today is received by over 500,000 Minnesota homeowners. Homestead Credit Refunds are provided on a sliding scale and based on your household income and property tax bill. The refund increases as your property taxes increase, up to as much as $3,310 each year.

Excess property taxes: Refunds will range from 53% to 88% of the excess property tax you pay, as determined by a state formula based on income.

What is the Homestead Credit Refund?

How do I know if I qualify for the Homestead Credit Refund?

Your total household income is less than $139,320.

You are a Minnesota resident for at least half of the year.

You owned or occupied your home as of January 2, 2025.

Your property is classified as your homestead.

You have no delinquent property taxes.

As many as 65% of homeowners statewide may be eligible for annual state property tax refunds if property taxes make up more than 1% to 2.5% of household income (a threshold that adjusts based on that income). If eligible, you may apply for the Homestead Credit Refund by mailing in the paper M1PR form or via the Minnesota Department of Revenue’s website.